How could new European emissions targets impact the construction sector?

22 February 2024

Imafe: rh2010 via AdobeStock - stock.adobe.com

Imafe: rh2010 via AdobeStock - stock.adobe.com

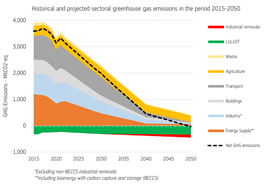

Europe is planning to set itself a new intermediate target to cut net greenhouse gas emissions by up to 90% by 2040, as it continues its journey towards climate neutrality by 2050.

The European Union (EU) has already set a path to cut emissions by 55% (against 1990 levels) by 2030 and to do so, it will need to almost triple the average annual reduction level achieved over the past decade.

Reaching the 2030 emissions target will largely happen through fast reductions in sectors like power generation. But beyond this date, attention will turn to sectors where it is tougher to bring emissions down, including the construction and built environment sectors.

Earlier this month, the European Commission (EC) presented its assessment for a 2040 climate target for the European Union. The Commission recommended reducing the EU’s net greenhouse gas emissions by 90%. That doesn’t mean that it has already set the post-2030 energy and climate policy framework.

Alongside its recommendation, it published an impact assessment looking at the various effects different policies could have on different areas of the European economy, including the construction sector.

The assessment considers three different scenarios: the first (S1) delivers a target that is the ‘linear’ reduction path of net greenhouse gases between 2030 and 2050; S2 involves reaching a reduction of at least 85% by 2040, reflecting the trends in S1 with a further deployment of carbon capture and e-fuels; while S3 builds on S2 and relies on a fully developed carbon management industry by 2040, as well as higher production and consumption of e-fuels, to reach a 90% reduction by 2040.

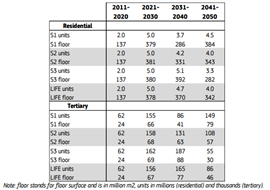

As far as the built environment is concerned, all three scenarios involve further electrification through the sustained deployment of heat pumps. Meanwhile, S1 assumes a low annual building renovation rate in 2031-40 and high in 2041-50, whereas S2 assumes a similar average renovation rate in 2031-40 and 2041-50, and S3 assumes a high annual renovation rate in 2031-40 and low in 2041-50.

Here’s how the EC assessed the impact of the targets on construction:

- The three scenarios imply an average of four million more renovations a year in 2031-50. The scale of the push for renovation, combined with the fact that it could last for decades should mean job opportunities with long-term prospects, the impact assessment found. It predicted that the renovation drive alone could generate 250,000 jobs over 2031-50, which is an additional 160,000 jobs compared to the level in 2011-20. The figure is only small compared to total construction employment but still significant and only counts the direct employment impact, without considering the impact further along the value chain.

Average annual renovations in residential and tertiary sectors (Source: PRIMES)

Average annual renovations in residential and tertiary sectors (Source: PRIMES)

- Renovation investment in the residential sector would amount to €50 billion a year across all scenarios. That is a significant increase compared to historic investment levels between 2011-2020 and about five times as much as required in tertiary sectors.

- Investment in training in construction will have little impact on the European economy. Increased training and reskilling costs of workers would have a small increase in aggregate labour costs to employers and a small negative impact on gross domestic product (GDP) by 2040 of less than 0.1% as compared to the no-skilling costs baseline, the impact assessment calculated. Even increasing the cost of training workers in sectors like manufacturing, introducing a cost of €5,000 per worker in construction and increasing the number of workers receiving training in low-carbon clean technology sectors to 568,000 still only generated a 0.25%-0.35% hit to GDP in 2040, it found.

- Investment in new construction is expected to remain relatively small under all three scenarios. Meanwhile cumulative investment in building renovation under all three scenarios would be similar, even though S3 implies a bigger renovation driver earlier on. (See graph below).

- The transition could be an opportunity for small- and medium-sized construction companies (SMEs). That’s because all scenarios require the renovation of building stock to improve their energy efficiency, with the most ambitious, S3, calling for larger investment in renovation earlier on (2031-40). But it warned that to avoid shortages, the transition would need to anticipate demand for skills and supplies.

- Continued growth for construction. The impact assessment assumes that the construction industry’s GVA (gross value added) would continue to grow, in part due to renovations, but at a slightly lower pace than total GVA, as the EU’s population declines, implying lower demand for new residential builds. Overall, the share of the construction sector in total GVA is projected to decline only marginally from around 5% of the current total. And in absolute terms, it is projected to be between 27% and 40% higher in 2040 and 2050 respectively, compared to 2016-20.

The latest communication from the EC launches the process of setting the 2040 climate target for the EU. It opens a political debate on the choices for European citizens and governments on the way forward, which will then inform the next Commission, which takes office after the 2024 European elections.

The next Commission will then make a legislative proposal to include the 2040 target in the European Climate Law, ahead of making sure that the post-2030 policy framework is in place.

Brought To You By

|

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM