Top Stories

Major US-based streamer is building a US$1-billion studio in New Jersey

Premium Content

Contractors have successfully topped out a main tower of the Shituo Yangtze River Bridge in China.

A hurricane wiped out permanent access to a Florida island, and a major restoration project is nearing completion

The new facility will include purpose-built storage for 28 million specimens

Employment increases in just over half of metro areas, amid demand for certain types of project

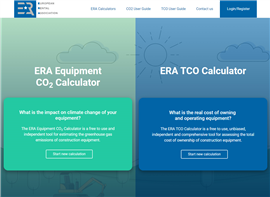

Sponsored Content

Construction Sourcing Guide

The comprehensive guide for buyers and users of construction equipment

The Construction Sourcing Guide is an invaluable tool for

industry professionals, containing information on over 9,000 products from over 240 equipment

producers and providers.

See a demo of how it works.

GO TO WEBSITE

Insights and analysis from the global construction industry

Contacts

Andy Brown

Eleanor Shefford

Catrin Jones

Peter Collinson