Ashtead’s 26% rental-revenue jump reflects rising Sunbelt rates

19 September 2022

Photo: Sunbelt Rentals

Photo: Sunbelt Rentals

One industry benefitting from a busy construction industry working through challenging economic uncertainty is equipment rental, as the financial performance of large chains such as Sunbelt Rentals suggests.

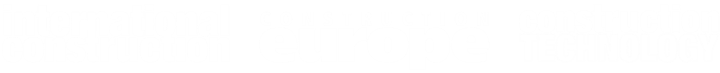

Revenues of Sunbelt’s parent company, UK-based Ashtead, jumped 22% over the three months ending July 31 to $2.26 billion. Operating profits were up 26% to $594 million.

Virtually all of this growth came from rental revenues that rose 26% in the quarter. The strong start urged Ashtead to increase its full-year 2022 forecast to 17-20% revenue growth in 2022.

Ashtead Group operates as Sunbelt US, Sunbelt Canada and Sunbelt UK and while all of its operations are growing, the U.S. brand is the key driver for the group’s volume and growth. Sunbelt US generated 84% of Ashtead’s revenue and 91% of the group’s profits in the quarter.

Sunbelt US rental revenue jumped 26% in the quarter to $1.39 billion. Rental revenue growth has been driven by both volume and rate improvement in what the company says “continues to be a good rate environment.”

This is an example of a trend being seen throughout the equipment rental industry, which itself is predicted to grow 11.2% in 2022 to nearly reach $55.9 billion, according to the most recent forecast by the American Rental Association. Construction equipment rental revenue specifically is looking at a 12.5% increase in 2022 to surpass $41.6 billion. Growth is expected to slow to 7% in 2023, 2% in 2024, 3% in 2025 and 3% in 2026.

“Rental revenues grow when the fleet expands or when rates increase,” John McClelland, Ph.D., ARA vice president for government affairs and chief economist explained in a recent report from the American Rental Association. “Both things are happening today, however, supply chain issues are inhibiting fleet growth while inflation is pushing rates higher.

“In the past we saw a lot of revenue growth that we attributed to fleet growth. Now we are seeing revenue growth that is being driven by higher rates,” he said.

And higher rates have a direct impact on contractors looking to complete projects on time and on budget.

Ashtead in acquisition mode

Table: Ashtead Group

Table: Ashtead Group

The scale of Sunbelt US success, in particular, is reinforcing Ashead’s strategy of growing specialty businesses and broadening end markets, largely through acquisition. The U.S. operation’s rental revenue grew 20% organically and acquisitions since the first of May last year contributed 6% of rental revenue growth. Thirty-eight-percent growth in their specialty rentals businesses outpaced general-tool rental by 15 percentage points, virtually guaranteeing Sunbelt will continue to acquire companies.

Rental-only revenue of the Sunbelt UK business rose 5% to £104 million. But the end of free mass COVID testing in April 2022 dropped revenue associated with testing sites from the Department of Health significantly. Excluding the impact of the work for the Department of Health, rental-only revenue increased 19%. Total revenue decreased 4% to £182m (2021: £190m) reflecting the volume of ancillary and sales revenue associated with the work for the Department of Health, which accounted for 16% of revenue in the quarter.

Canada’s rental-only revenue increased 18% to C$131 million. Sunbelt’s Canadian business is growing similarly to the U.S., with strong volume and rate improvement.

“In the quarter, we invested $699 million in capital across existing locations and greenfields and $337 million on 12 bolt-on acquisitions, adding a combined 33 locations in North America,” says Ashtead’s chief executive, Brendan Horgan.

Horgan added that acquisitons are not straining the group’s credit, saying they maintain “a strong and flexible balance sheet with leverage near the bottom of our target range.”

Acquisitions in the first quarter include:

- Specialty business Movietech Camera Rentals Limited and Movietech Cymru Limited.

- The power rental division of specialty business Filmwerks LLC.

- Georgia general tool business Mashburn Equipment LLC.

- MacFarlands Limited, a general tool business in Nova Scotia and New Brunswick.

- California general tool business Amos Metz Rentals & Sales LLC.

- Pennsylvania general tool business George’s Tool Rental Inc.

- Specialty business PKE Lighting Holdings Limited.

- Maine general tool business Milford Rent-All Inc.

- Indiana general tool business R&N Tool Rental Inc.

- Utah general tool business Chump Management LC, trading as Power Equipment Rental.

- Pennsylvania general tool business Harmar Contractors Equipment Inc.

- California general tool business A-V Equipment Rentals Inc.

Since the period end, Ashtead spent another $183 million on these seven acquisitions:

- Alberta general tool business Compact Rentals Limited.

- New Jersey general tool business Rental Country Inc.

- California general tool business R.J. Lalonde Inc.

- Alaska general tool business Alaska Pacific Rental LLC.

- Specialty business Optimum Power Services.

- Specialty business Flagro Industries Limited.

- General tool business Xtreme Rentals Ltd.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM